Tax Policy Center on Twitter: "TPC today just published its analysis of how the Inflation Reduction Act would impact taxpayers at different income levels. Overall, the bill is highly progressive and mainly

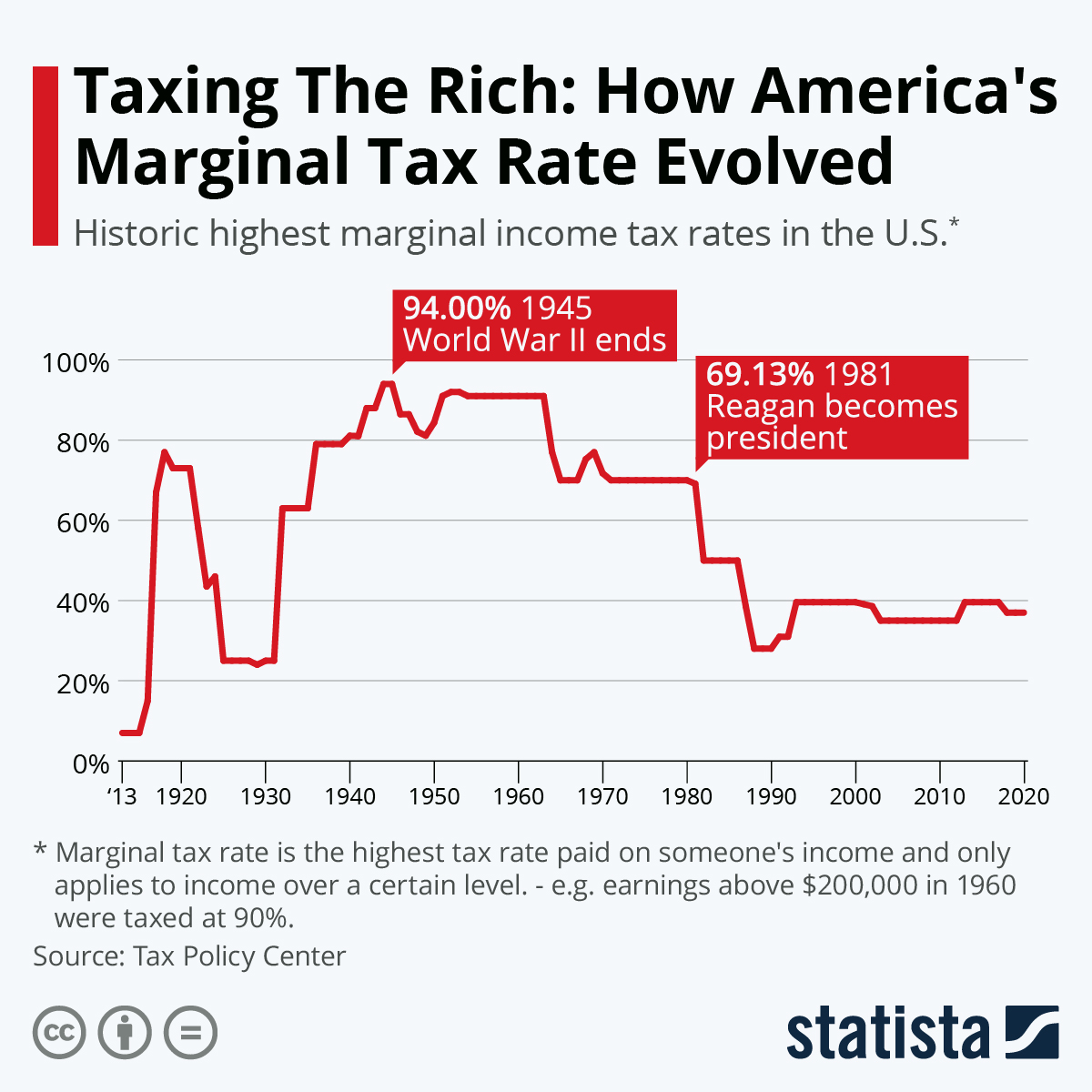

Senate Republican tax bill gives the top 1 percent of households a $32,500 tax cut; Bottom 20 percent will pay $10 more | Economic Policy Institute

/cdn.vox-cdn.com/uploads/chorus_asset/file/9637981/graf_1.png)

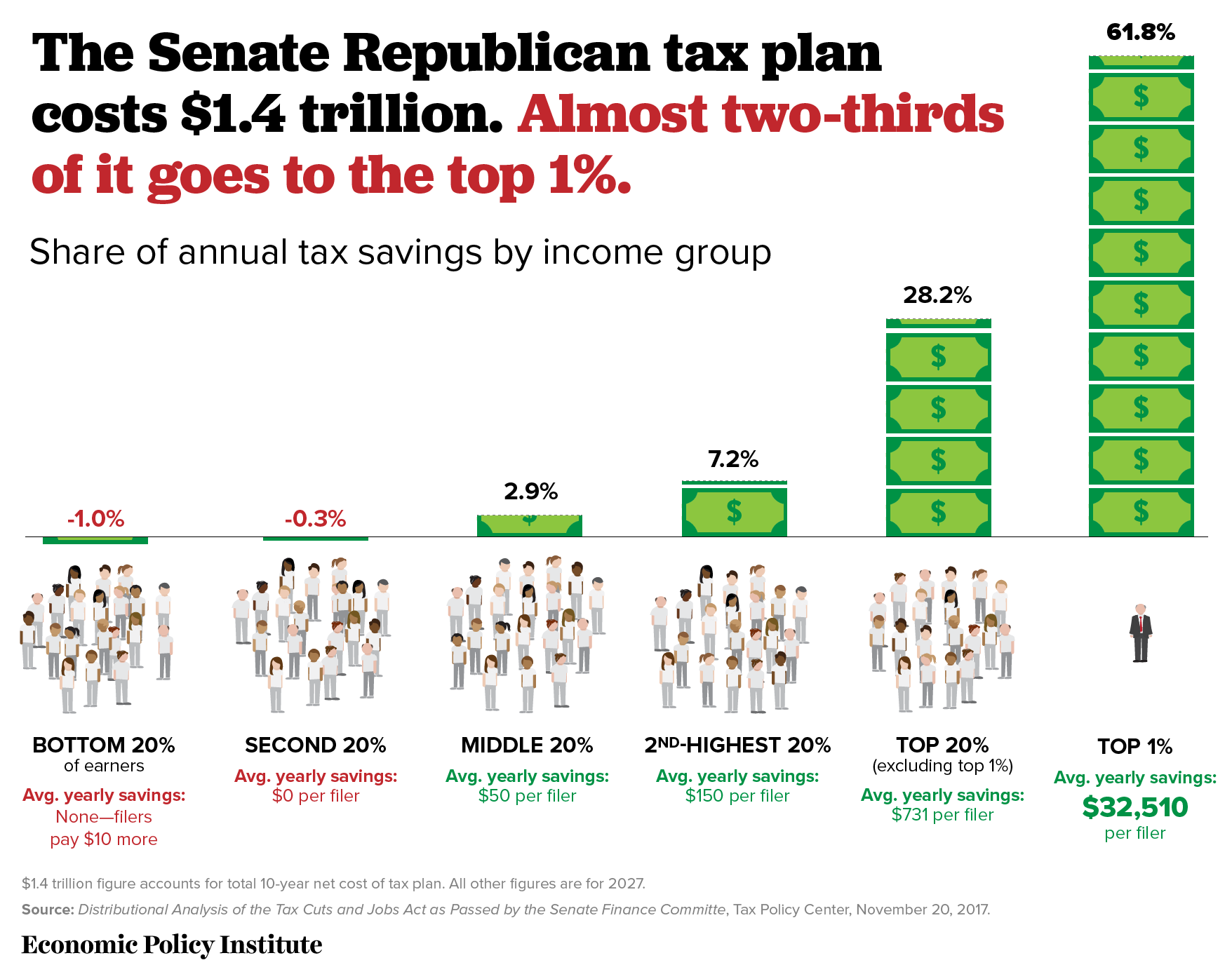

The numbers are in, and the House Republican tax bill raises taxes on over a quarter of Americans - Vox

New report from Urban-Brookings Tax Policy Center reveals how COVID-19 is affecting the fiscal health of states - Avalara